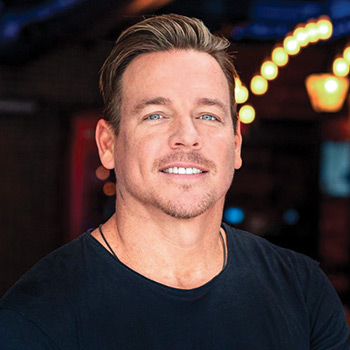

MoneyShow editor-in-chief and emcee Mike Larson has been analyzing, writing, and speaking about the capital markets for a quarter century. In his welcome remarks, he will share his take on key market developments and what he sees unfolding in 2024. Plus, Mike will provide further details on what your expert speakers plan to cover and how you can get the most out of your MoneyShow experience.

Join Mike Larson for this in-depth session, designed to bring you the latest intelligence available so you can identify and profit from the opportunities in today's markets. The knowledge you gain by attending this session can help you make better investing or trading decisions tomorrow.

There are only three things you've got to get right to line up big profit potential, minimize risk, and ensure the highest probability of success. Keith will share counterintuitive knowledge and research drawn from 43 years in global markets that will change your view about what it really takes to make money in today's markets.

Positiviti Lending is a pioneering micro-lending platform on a mission to transform lives and communities. With a laser focus on financial inclusion, we're revolutionizing access to capital for underserved populations in Kenya. Our innovative approach combines technology, data-driven insights, and a profound commitment to impact, making us a catalyst for economic growth and empowerment. Join us in reshaping the landscape of opportunity and investing in a brighter future for all.

Alternative assets like cryptocurrencies and gold languished on the sidelines or in the penalty box for some time. But they’re showing signs of life again. Meanwhile, niche commodities like uranium have captured the attention of investors. Our panelists will explore these and other alternative assets—and help you figure out if they make sense for YOUR portfolio.

Join seasoned market experts Ralph Acampora and Craig Johnson as they share their outlooks for 2024. This dynamic discussion will cover which sectors appear most attractive in current economic conditions, what lies ahead for the “Magnificent Seven”, and how you can use this knowledge to ignite your portfolio.

There are advantages of investing in joint venture oil drilling projects, such as current oil price leading to huge potential profits, tax advantages, choosing the right type of project for you, and the rapid and potentially extremely high rate of return on investment. Dan Sauer will demonstrate this opportunity and describe what has made him consistently successful in this sector.

We view AI as the most transformative technology trend since the start of the Internet in 1995 and believe many on the Street are underestimating the $1 trillion of AI spending set to happen over the next decade in a bonanza for the chip and software sectors looking forward with Nvidia and Microsoft leading the way.

Cutting-edge discoveries and revolutionary developments are transforming “old favorite” sectors for investors. In this moderated discussion, you’ll find out what’s driving the future forward in groups like energy and big tech. Expect to learn more about AI, and its effects on energy innovation and the manufacturing sector.

The “Magnificent Seven” technology stocks dominated market performance in 2023, with cumulative gains of more than 71% in the year-to-date through November. But can these seven, widely held tech names continue to push the averages higher in 2024? Or will new leaders emerge? Meanwhile, new advances in Artificial Intelligence (AI), robotics, and healthcare tech/wearables are driving the American innovation economy forward. Are you positioned optimally to profit? Are there stocks that deserve a closer look? Tune into THIS panel for key intelligence on emerging opportunities for your portfolio.

In this session, CME Group’s Craig Bewick will moderate a panel discussion with Blue Line Futures’ Bill Baruch and Phil Streible. Please join us as they discuss their outlooks on current macroeconomic trends and how traders can use CME Group products to express their views on uncertainties tied to economic events. The dialogue will draw from the speakers’ backgrounds as they share their expertise and perspectives on various futures trading strategies.

The macro is impacting markets. Markets are being moved by economic growth data, inflation data, the Fed, and geopolitics. Kristina will examine the macro environment, sharing her base case. She will also cover two alternate scenarios. Finally, she will explore the investment implications of the macro environment and today’s major risks.

In this keynote presentation, Brad Thomas will discuss the reasons to own REITs right now and reveal the strategy for his REIT Index and the all-new REIT ETF. Brad considers this smart strategy to be a perfect way to sleep well at night without the aggravation of being a landlord.

Interest rates, the stock market, and business spending indicators will determine who will run the country in the next four years. In this important election year, Dr. Mark Skousen will reveal his favorite economic and financial indicators that will help you invest wisely and make money in 2024

A new president takes office in 2025. But in the meantime, treacherous waters lie ahead. Here’s what investors can do.

Many investors prefer the long-term predictability and consistent results of conservative stock and mutual fund investments. But even a small allocation to “alternatives” can yield a big performance impact. Sometimes just steering 10% or 15% of your portfolio to a high-quality, proven alternative investment can increase your overall portfolio performance by 25% to 45% while maintaining a conservative risk profile. At this session, you’ll learn how that’s possible—and better understand the gains that can be generated from alternatives.

Last year was a year of inflation worries, interest rate hikes, housing market problems, and banking sector woes. Yet the recession many prognosticators feared never came to pass—and the markets managed to march higher into the year-end.

Mark will provide his updated outlook for growth and tech stocks heading into 2024. Can growth/tech stocks outperform in a 5% rate environment? Where are the opportunities today? Which stocks to avoid? Is the AI trend over-hyped or under-appreciated?

The current confluence of clean energy policy, lower costs for renewables and energy storage, a mobility revolution, the potential of hydrogen and mitigation tools such as carbon capture, and new technologies and advanced materials have made the Energy Transition and the electrification of everything a multi-decade, investment mega theme. The energy transition and the move towards a more sustainable and circular economy is the largest change to the global economy since the Industrial Revolution, the most significant mustering of capital in history, and represents a once-in-a-century opportunity for investors

Having previously seemed by many on an unstoppable upward trajectory towards global economic domination, China's position in the global economy now appears much less certain. Some observers today go so far as to ask if China might be facing a Lehman Moment reminiscent of the turning point that brought on the 2008-9 Global Financial Crisis. As if that is not producing enough anxiety, concern keeps growing that China's swelling belligerence towards Taiwan could spill out into an all-out hot war that will draw in the United States, What does this mean for global economics and security? How to assess what drives China's market dynamics and policies? How should investors view the related risks and opportunities?

Saudi Arabian production cuts. Wavering Chinese energy demand. War in the Middle East. Shifts in Washington energy policy. The crude oil, petroleum products, and natural gas markets dealt with all kinds of conflicting forces in 2023. But when it was all said and done, a barrel of oil cost roughly the same at the end of the year as it did at the beginning. That said, investments in “Big Oil” stocks, explorers, refiners, energy services firms, and Master Limited Partnerships (MLPs) have performed phenomenally well over the past few years. The question for energy investors in 2024 is whether that will continue as energy supplies rise. Find out in this panel.