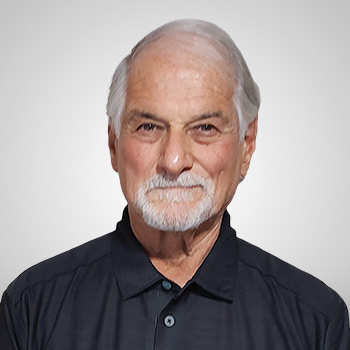

Join Mike Larson for this in-depth session, designed to bring you the latest intelligence available so you can identify and profit from the opportunities in today's markets. The knowledge you gain by attending this session can help you make better investing or trading decisions tomorrow.

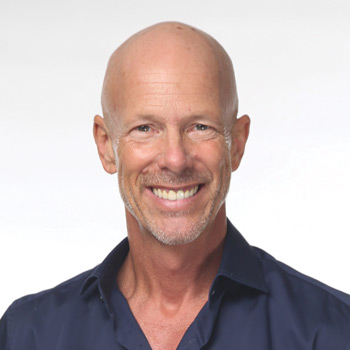

Join Barry Cohen for this in-depth session, designed to bring you the latest intelligence available so you can identify and profit from the opportunities in today's markets. The knowledge you gain by attending this session can help you make better investing or trading decisions tomorrow.

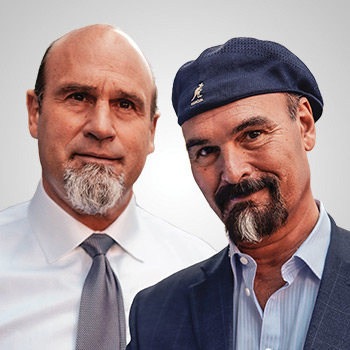

Join Jon and Pete Najarian for this in-depth session, designed to bring you the latest intelligence available so you can identify and profit from the opportunities in today's markets. The knowledge you gain by attending this session can help you make better investing or trading decisions tomorrow.

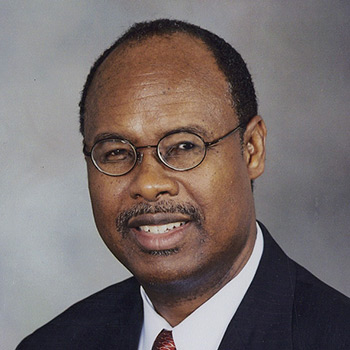

Join Jeffrey Saut for this in-depth session, designed to bring you the latest intelligence available so you can identify and profit from the opportunities in today's markets. The knowledge you gain by attending this session can help you make better investing or trading decisions tomorrow.

Join John Carter for this in-depth session, designed to bring you the latest intelligence available so you can identify and profit from the opportunities in today's markets. The knowledge you gain by attending this session can help you make better investing or trading decisions tomorrow.

Despite the seemingly never-ending campaign cycle, the four-year cycle continues to dominate the market. Following a textbook midterm bear in 2022 and October bottom, the market continues to closely track the pattern in 2023. Heading into 2024, with a sitting president seeking reelection, the power of incumbency is likely to keep a recession at bay paving the way for a positive 2024. Jeff will take a quick dive into the powerful four-year cycle and share his views for the upcoming year.

The new year is right around the corner. So, NOW is the time to get your portfolio ready for all that 2024 has to offer. Your expert panelists will name their favorite stocks for the upcoming year, as well as explain why they like them and what key developments and milestones could propel them even higher. Since the panel is interactive, get ready to listen closely—then follow up with any questions you want answered!